Vehicle Like Kind Exchange Worksheet

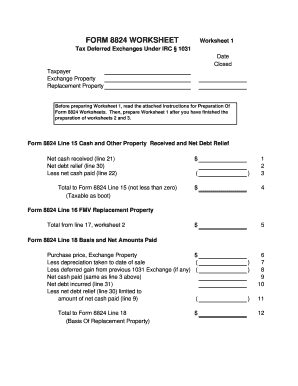

0 Line 22 23. Part iii realized gain or loss recognized gain and basis of like kind property received caution.

Http Www 1031 Us Wp Content Uploads Form8824workbookfor2018 Pdf

If you transferred and received a more than one group of like kind properties or b cash or other not like kind property see reporting of multi asset exchanges.

Vehicle like kind exchange worksheet. If the old car was used 100 for business and is traded for a new car that will be used 100 for business the original basis of the new car is the adjusted basis. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out. COMPLETING PART I INFORMATION ON THE LIKE-KIND EXCHANGE.

Like kind exchange worksheet excel. Exchanges of vehicles after Dec. WikipediaWikipedia text under CC-BY-SA licenseWas this helpful.

Wikipedia Revenue1031 exchange This kind of transaction is also called a 1031 exchange because Internal Revenue Code section 1031 of the US. Cost of Ford is 26356 before trade in. A Like Kind 1031 Exchange Go To Guide For Attorneys Pdf You may have searched high and low tried unsuccessfully to use a couple worksheets and even read all the instructions in the irs publication but still had difficulty figuring out the form and what goes where.

Form 8824 Instructions provide information on general rules and how to complete the formLike-Kind Exchanges - Real Estate Tax Tips Internal Revenue Servicehttpswwwirsgovbusinessessmall-businesses-self-employedlike-kind-exchanges-real-estate-tax-tipsPeople also search forSee all 5 SampleDepreciationSectionPersonal PropertyCryptocurrencyData from. Finally all pictures we have been displayed in this website will inspire you all. Starting in 2018 the like-kind exchange treatment is limited to the exchange of real property.

I have disposed of the old vehicle via a like kind exchange entered a new asset with a tax basis of 7000 and entered another new asset for the new vehicle. However if the QI defaults on its obligation to acquire and transfer. 31 2017 may involve a taxable gain or a loss.

The new vehicle cost 20851 and included a 7000 trade-in allowance for the old vehicle. If you fail to meet the timing requirements because of the QI your transaction wont qualify as a deferred exchange and any gain may be taxable in the year you transferred the property. When youre using it youll have your students enter in their homework assignment and then you can enter in the assignments grade.

Discover learning games guided lessons and other interactive activities for children. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example. Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character the IRS wont recognize it as a gain or loss.

31 2017 may involve a taxable gain or a loss. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Due to changes to Section 1031 exchanges listed in the Tax Cuts and Jobs Act see.

Adjusted basis of like-kind property you gave up 6453 Change in Liabilities of 35017 - 16145 25325 Line 19. A like-kind exchange also known as a Section 1031 exchange is a way of trading or exchanging assets and in many cases deferring gain on the trade or exchange. Generally in an exchange of vehicle the cash does not go to your bank account.

Gain or loss will be recognized on the vehicle traded-in depending upon the trade-in value and remaining basis in itworksheets covering math reading social studies and more. If you fail to meet the timing requirements because of the QI your transaction wont qualify as a deferred exchange and any gain may be taxable in the year you transferred the property. ThanksGive more feedback 2021 Microsoft Privacy and CookiesLegalAdvertiseHelpFeedbackAllPast 24 hoursPast weekPast monthPast year.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. This calculator is designed to calculate recognized loss gains and the basis for your newly received property. For tax purposes the value of the new vehicle assuming a like kind exchange - business vehicle for business vehicle will be the book value of the old vehicle with depreciation taken up to date of sale plus any excess cash you pay for the new vehicle.

So I added in the 6528 as a basis adjustment difference between 10k depreciable basis so the total basis of the like kind property given up becomes 7029. Discover learning games guided lessons and other interactive activities for children. The kind exchange worksheet works in much the same way as a grade book.

Include an attachment if additional space is required. However certain exchanges of mutual ditch reservoir or irrigation stock are still eligible. A like-kind exchange can involve the exchange of one business for another business one real estate investment property for another real estate investment property livestock for qualifying livestock and exch.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Javascript is required for2020 Instructions for Form 8824 - IRS tax formshttpswwwirsgovpubirs-pdfi8824pdfPDF fileproperty given up and receipt of like-kind property is treated as a like-kind exchange. If a debt you owe on the old vehicle is taken over by the other party or if the other party.

For Lines 1 and 2 in Part I the exchanger should show the address and type of property. We traded-in a vehicle the cost 1556507 and had accumulated depreciation of 1517605. Realized Gain 9146 Line 20.

1031 Exchange Analysis Sample Worksheet for IRS Form 8824 Screenshot. Property given up and receipt of like-kind property is treated as a like-kind exchange. Gain or loss will be recognized on the vehicle traded-in depending upon the trade-in value and remaining basis in it.

34 471 Line 18. Include all property involved in each exchange on the single Form 8824. Discover learning games guided lessons and other interactive activities for children.

1031 Exchange Calculation Worksheet And Sec 1031 Exchange Worksheet. Im getting 471 of deferred gain on the 8824 and basis of new car as 26258. Excel spreadsheet to help you with the preparation of IRS Form 8824 LikeKind Exchanges If - you would like a copy of this copyrighted spreadsheet please provide us with your email address and we would be more than happy to forward the spreadsheet.

Like kind property is property of the same nature character or class. If you received actual cash in had it is not an exchange. Like kind exchange worksheet 1031 exchange calculator excel.

A like-kind exchange under United States tax law also known as a 1031 exchange is a transaction or series of transactions that allows for the disposal of an asset and the acquisition of another replacement asset without generating a current tax liability from the sale of the first asset. Exchanges of vehicles after Dec. Like-kind means that the property you trade must be of the same type as the property you receive.

Loan taken on new car for 19229. Like-kind means that the property you trade must be of the same type as the property you receive. 1 2018 exchanges of personal or intangible property such as machinery equipment vehicles artwork collectibles patents and other intellectual property generally do not qualify for nonrecognition of gain or loss as like-kind exchanges.

Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot. You can also e- mail your request to. Like kind exchange worksheet excel and irs 1031 exchange worksheet can be beneficial inspiration for those who seek an image according specific categories you can find it in this site.

IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for those who seek an image according specific categories you can find it in this website. Line 23 and the total basis of all like-kind property received on Line 25.

Https Www Expert1031 Com Sites Default Files Guidebook2018 Pdf

Https Www Expert1031 Com Sites Default Files Guidebook2018 Pdf

Renting A Car Esl Worksheet By Meuanjo

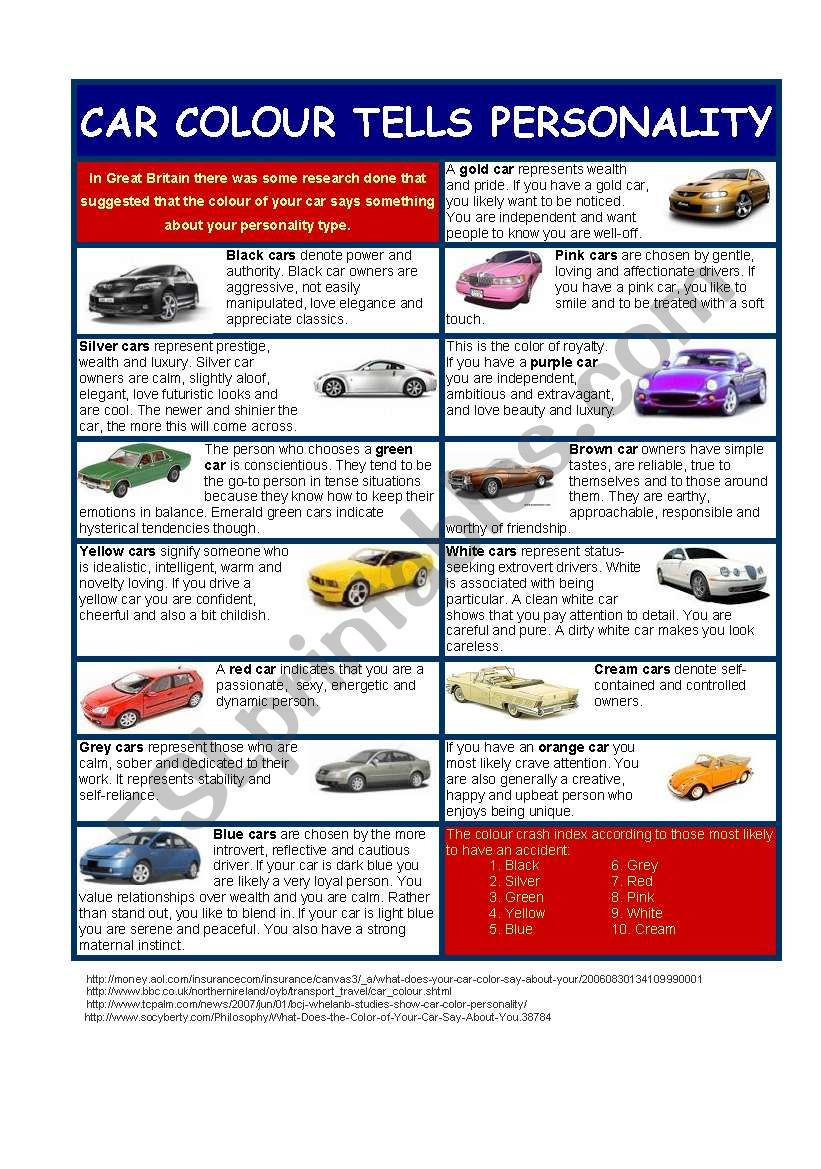

Let S Talk About Cars English Esl Worksheets For Distance Learning And Physical Classrooms

Https Www Expert1031 Com Sites Default Files Guidebook2018 Pdf

Like Kind Exchange Worksheet Excel Nidecmege

Depreciation Like Kind Exchange Examples

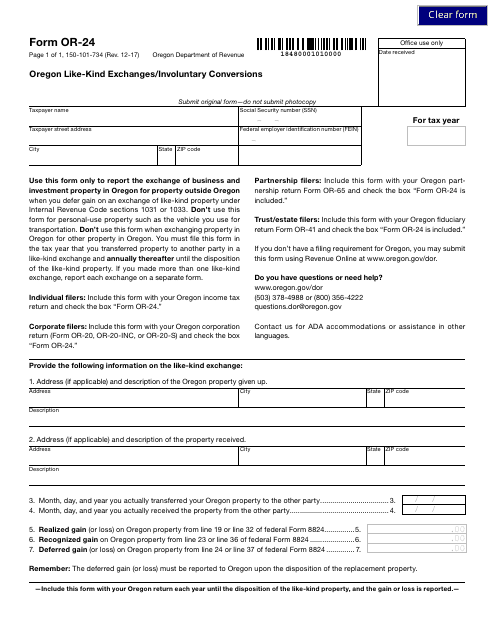

Form Or 24 Download Fillable Pdf Or Fill Online Oregon Like Kind Exchanges Involuntary Conversions Oregon Templateroller

Like Kind Exchange Worksheet Excel Nidecmege

Http Www 1031 Us Wp Content Uploads Form8824workbookfor2018 Pdf

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Car Colour Tells Personality Esl Worksheet By Naron

Like Kind Exchange Worksheet Excel Promotiontablecovers

Like Kind Exchange Worksheet Excel Nidecmege

Like Kind Exchange Worksheet Excel Nidecmege

Like Kind Exchange Worksheet Excel Promotiontablecovers

Like Kind Exchange Worksheet Excel Promotiontablecovers

Https Www Expert1031 Com Sites Default Files Guidebook2018 Pdf